KissFC

Third Profile of Use

3.

Investment on installments

with Future Value:

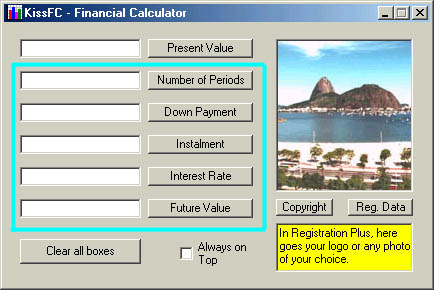

Mr. Joseph P. learned that the interests on a purchase on installments can be seen as a tax that we pay for our impatience. So, he decides to do the opposite: to save a certain amount every month, until he has $20,000.00, when he'll buy a nice car. For the down payment he already has $ 4,000.00 and would like to deposit a maximum of $600.00 a month in that account. He is informed that a saving account, although not the best profitability application, is the safer one. His manager informs him that that it should yield about 0.7% a month in the near future. He enters the following data in KissFC:

Down

Payment: 4000.00

Installment:

600.00

Interest

Rate: 0.7

Future

Value: 20000.00

He

clicks Number of Periods

and gets 23.526 months as answer. He finds the period of 24 months

adequate

for his needs and he re-does the calculations entering 24 in

the

box "Number of Periods". Clicking Down Payment, he

finds $3,704.01

for the new value of the "Down Payment". He thinks it over and

concludes:

I won't reduce the "Down Payment". I'd rather increase the final value

of reference, so I can, perhaps, use the difference to pay the tax. So,

he enters 4000.00 in box "Down Payment", clicks Future

Value

and sees that he will have $20,349.93 by the end of the 24 months.

When everything is practically decided, the manager suggests him a little more aggressive - and yet quite safe - application in fixed income securities, with a net income of 1.2% a month. Mr. Joseph P. knows that safety and profitability, usually, run towards opposite directions, but decides to check with KissFC how faster he would get the same future value if he opted for the new rate.

Changing the "Interest rate" to 1.2 and clicking Number of Periods, he gets 22,173 months. Then, he decides to calculate which rate can generate the $20,349.93 in 20 months. Entering 20 in "Number of Periods" and clicking Interest Rate, he gets at 1.934. The manager shows him some investments in bonds and shares that can reach this rate, but none of them even guarantees the return of the applied value. So, Mr. Joseph P. finally decides for the investment below, obtained by calculating the "Down Payment" with KissFC:

Number

of Periods: 22

Installment:

600.00

Final

value: 20350.00

Net

Interest rate: 1.2

Clicking Down Payment, he gets the amount of $4,111.91 for the "Down Payment".

I think the examples in those three profiles of use demonstrate KissFC Financial Calculator's great potential. Shortly, on the "Frequently Asked Questions - F.A.Q "., we'll show how you can load several copies of the calculator on your desktop, besides the calculator that comes with Windows. That combination and "copy & paste" operations for transportation of values, allow for complex and sophisticated financial calculations.

![]()